FOLLOW US ON LINKEDIN

For regular product, business and people updates, follow our LinkedIn page.

FOLLOW US NOW

Diary of an Apprentice

National Apprenticeship Week 2024: meet the iprism apprentices

iprism-owned Metier appoints new Senior Underwriter

iprism awarded Chartered Insurance Underwriting Agents status

Congratulations to Aaron Woodhams and Bradley Harmer

iprism celebrates double-digit growth

iprism boosts distribution with Acturis integration

Aaron Woodhams talks commercial underinsurance

iprism acquires Metier Underwriting

BLOG: Escape of Oil: a viscous issue

iprism give community grant to food bank

iprism in the news

iprism boosts distribution with Acturis integration

iprism give community grant to tennis academy

BLOG: A perfect storm for underinsurance?

iprism broadens distribution with SSP integration

iprism named an Insurance Times 5-Star MGA

iprism Sponsor 2021 UK Broker Awards

iprism appoints Head of Underwriting

iprism voted best MGA for Liability & Property

iprism support Computers for Schools Initiative

BLOG: Down at the bottom of the garden...insuring the new office

iprism launches new e-trade Excess of Loss offering to brokers

BLOG: What's under the tree this Christmas?

Ian Lloyd features on The Insurance Broker Podcast

iprism shortlisted for Insurance Times Award

iprism Welcome New Look for Home Products

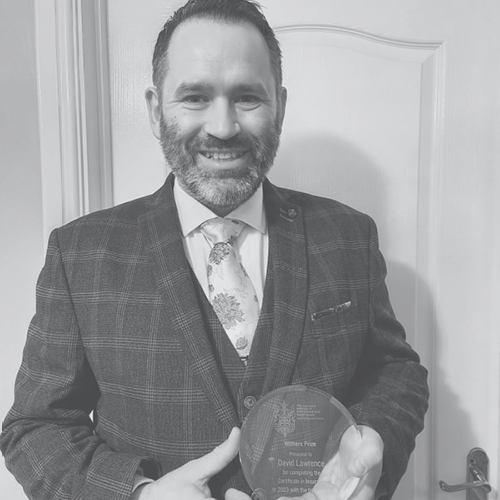

Gary Johnson Celebrates 45 Years in Industry

Dare Ian in aid of The Pulmonary Fibrosis Trust

iprism Include Legal Expenses as Standard

BECOME A BROKER

By becoming an iprism broker you will gain access to a comprehensive range of quality insurance solutions, enabling you to serve your clients with peace of mind.

Find Out More